The new proposed taxation rates on property have been tabled to Council by the Overstrand Executive Mayor, Dr Annelie Rabie, at their meeting on 29 March 2023.

Taxpayers will now be able to do their own calculations in this regard. This calculator will be on the municipal website as well.

In terms of the MPRA, property rates are calculated on the value of the land and of any improvements or buildings.

This value is based on the property’s market value – the price you would realistically get for a property in the open market, between a willing buyer and a willing seller.

Property Rates are levied as a cent in the Rand based on the market value of the property as reflected in the valuation roll.

Using this value as a base, a comparative value of all properties in a neighbourhood can be calculated. This assessed value is called the municipal value and is used by the Municipality for the levying of property rates.

Different rates are levied against different categories of property. Properties are grouped in categories based on zoning; for example, domestic properties and sectional title properties are generally residential, factories and warehouses are business.

Calculate your rates:

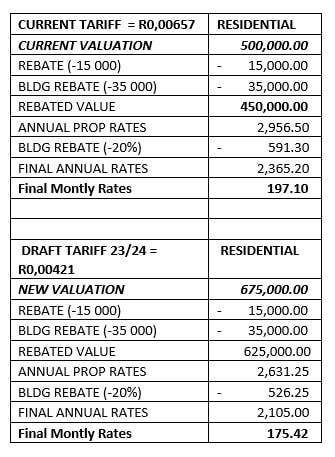

Calculation according to the rate in Rand as stated in the proposed Draft 2023/204 Budget of Overstrand Municipality.

Calculation for residential properties:

The proposed rate is to be 0,00421 cent in the rand.

This means that the calculation for determining how much a person will pay is done as follows:

Example: New valuation residential

= R675 000

Minus R15 000 Rebate not taxable

Minus R35 000 Building Rebate discount

Rebated value = R625 000

Annual property rates = R2 631.25

Minus 20% Building rebate = R526.25

Final annual rates = R2 105.00

Final monthly rates = R175.42

Compare this to the current 2022.23 tariff of 0,00657 cent in the rand.

Example: Current valuation residential

= R500 000

Minus R15 000 Rebate not taxable

Minus R35 000 Building Rebate discount

Rebated value = R450 000

Annual property rates = R2 956.50

Minus 20% Building rebate R591.30

Final annual rates = R2 365.20

Final monthly rates = R197.10

Calculation for business properties:

The proposed rate is to be R0.0073680, thus indicated as cent in the rand.

This means that the calculation for determining how much a person will pay is done as follows:

Municipal value x Rate in Rand ÷ 12 months = monthly rate payable

R 5 000 000 x R0,0073680 ÷ 12 = R 3 070 per month

Calculation for farms:

The proposed rate is to be R0.0010530, indicated as cent in the rand.

This means that the calculation for determining how much a person will pay is done as follows:

Municipal value x Rate in Rand ÷ 12 months = monthly rate payable

R 5 000 000 x R0,0010530 ÷ 12 = R 438,75 per month

Calculation for erven:

The proposed rate is to be R0,0063150, indicated as cent in the rand.

This means that the calculation for determining how much a person will pay is done as follows:

Municipal value x Rate in Rand ÷ 12 months = monthly rate payable

R 450 000 x R0,0063150 ÷ 12 = R 236,81 per month